The wages paid to the cook. C An explicit cost is an actual cost.

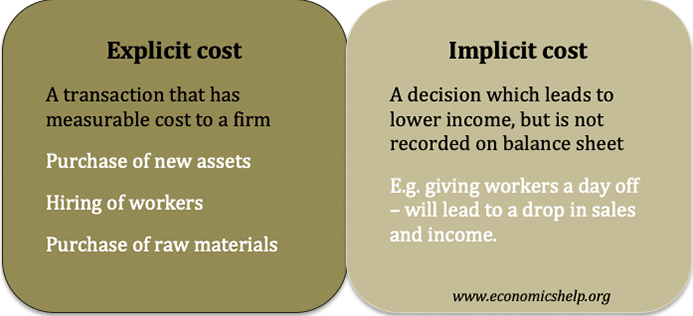

The Difference Between Implicit And Explicit Costs Economics Help

An implicit cost is a theoretical cost.

. The concept of relevant range applies to fixed costs but not to variable costs. They are the only costs that matter to business owners b. Explicit costs are payments the firm makes for.

Which of the following is false. The explicit costs are direct payments made to others while engaging in any transaction whereas implicit costs are indirect costs. The interest loss on money withdrawn from.

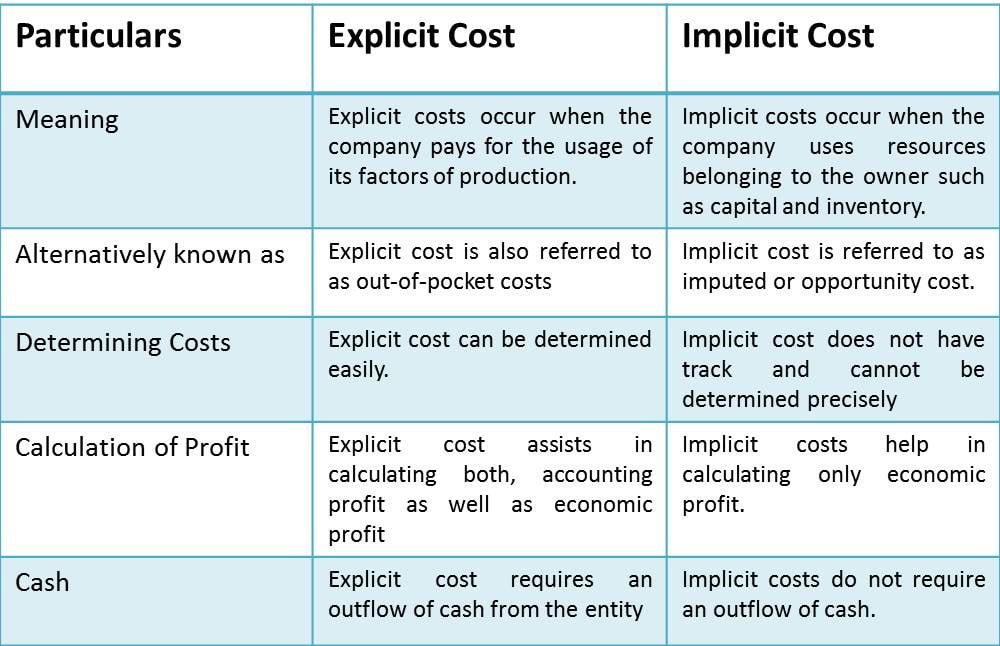

Is characterized by both a and c. Does not require an outlay of money. Economic costs include both explicit costs and implicit costs.

Explicit costs are input costs that require a monetary payment. Which of the following is true about explicit costs. Implicit costs do not represent an explicit outlay of money.

If she increases the size of her fitness gym and experiences diseconomies of. D An explicit cost is more important dollar for dollar than an implicit cost. Which of the following statements is true.

Which of the following statements about opportunity cost is TRUEI. Always less than zero. They usually exceed implicit costs.

Which of the following is false. As output increases fixed cost per unit. Implicit costs are economic costs not accounting costs.

Is characterized by both a and c. Both implicit and explicit costs are opportunity costs. A I II and III.

Implicit costs do not represent an explicit outlay of money. Does not require an outlay of money. Opportunity cost accounts for alternative uses of resources such as time and money.

All of the above. Opportunity cost only measures direct monetary costs. Economists consider all costs to be explicit costs.

They are not included when measuring accounting profit. The opportunity cost of your time. An explicit cost a.

Less than accounting profit if implicit costs are zero. Opportunity cost is equal to implicit costs plus explicit costs. Explicit costs are input costs that require a monetary payment.

All of the above are true. They are not included when measuring accounting profit. They are out-of-pocket expenses.

My explicit Cost is 300 which is the cost of acquiring bicycles. Thus out of the various options mentioned above the personal saving of the owner used as an investment in the business is not an explicit cost as there is no direct. The explicit and implicit costs associated with corporate default are referred to as the _____ costs of a firm.

Which of the following statements about cost behavior is true. Which of the following is an explicit cost. Explicit costs are accounting costs not economic costs.

Economic profit Accounting profit - implicit cost. 1 Answer to Which of the following statements about explicit costs is true. Sunk costs are irrelevant for any future action.

An explicit cost is an opportunity cost. A firm has 200 million in total revenue and explicit costs of 190 million. An explicit cost a.

The opportunity cost of the time you invested in your restaurant without getting paid. An implicit cost is a theoretical cost. Accounting profit Revenue - Explicit cost.

In the above example my economic profit is 700 - 500 200. Exercises 12 1. Rebecca owns a fitness gym.

Never less than accounting profit. An indirect cost of bankruptcy is the loss of key employees. B Economic costs include both explicit costs and implicit costs.

Outputs such as desks for its employees whereas implicit costs are non-expenditure costs that occur through the use of self-owned resources. They are not measured in terms of dollars. They are the opportunity costs of production.

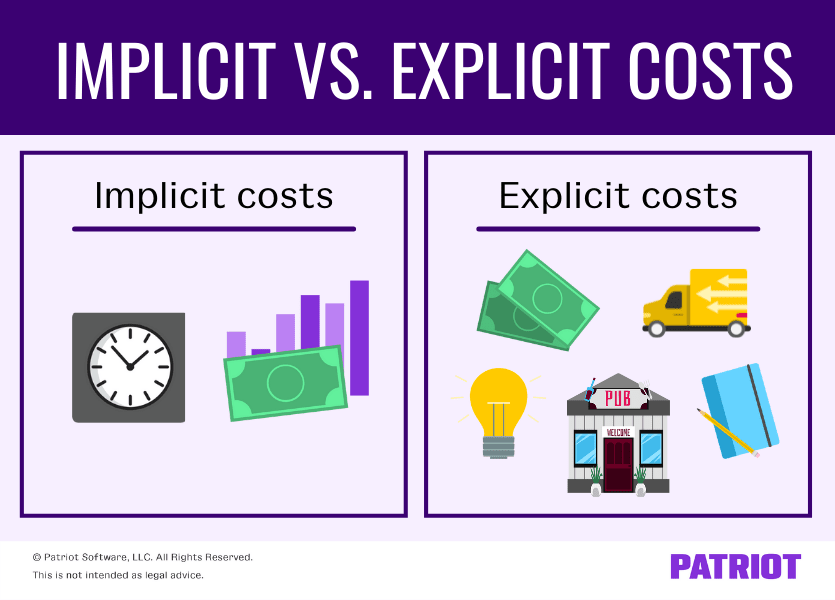

In economics costs can be in the form of explicit and implicit as implicit costs are opportunity costs and are opportunities for engaging in business. Is an opportunity cost. Which of the following is an explicit cost in Jims business venture.

The correct answer is View the full answer. Implicit costs would include. In economics there are 2 types of costs namely explicit costs and implicit costs.

Is characterized by both a and b. A costs item that is classified as variable relative to one activity base may be classified as fixed relative to another activity base. Which of the Following Is NOT an Example of an AccountingExplicit Cost.

Is an out-of-pocket expense. Opportunity cost only measures direct monetary costsIII. Less than accounting profit if implicit costs are greater than zero.

Which of the following is true about explicit costs. Inputs such as wages and salaries to its employees whereas implicit costs are non-expenditure costs that occur through the use of self-owned resources such as forgone income. They are the opportunity costs of production.

Final Exam Practice Test Supplemental Instruction Iowa State University Leader. While the explicit costs are accounting costs which are involved in the production of raw matter wages etc. Which of the following statements is true.

B І c III only. Opportunity cost accounts for alternative uses of resources such as time and money. Economists consider only some costs to be implicit costs.

The interest Jim does not earn because he invested his savings in his business Jims normal profit The salary Jim could have earned at another job The wages Jim pays his workers Answer A answer B. Revenue price of a good quantity sold. They are difficult to measure.

Which of the following statements about opportunity cost is TRUE. Which of the following is NOT an example of an accountingexplicit cost. An implicit cost is monetary.

D I and III only. Is an opportunity cost. Implicit and explicit costs are always equal.

Implicit costs are economic costs not accounting costs. They are out-of-pocket expenses. They are not measured in terms of dollars.

Is an out-of-pocket expense. Is characterized by both a and b. An explicit cost is more important dollar for dollar than an implicit cost.

In the above example my accounting profit is 1000 - 300 700. The interest rate opportunity cost of the money you had invested in the restaurant. Econ 101 Instructor.

Opportunity cost is equal to implicit costs plus explicit costsII. Explicit Costs and Implicit Costs. Which one of the following statements concerning bankruptcy is correct.

Group of answer choices An explicit cost is an actual cost. They are not included when measuring economic profit. They appear on the firms balance sheet.

A Explicit costs are accounting costs not economic costs. Which of the following is false. They are not included when measuring economic profit.

Difference Between Explicit Cost And Implicit Cost Tutor S Tips

Explicit Cost Vs Implicit Cost

What Are Implicit Vs Explicit Costs Examples How To Calculate More

0 Comments